We are currently at the rough-in stage of our new build project right now, and while we wait for the inspection, I wanted to share with you a summary of all the steps that take place in order to build a new house.

Firstly, let’s take a look at the stages, by answer these questions – what are the steps to building a house and how long will each of these take?

From obtaining a construction loan, getting construction insurance, finding reliable and good foundation contractors, siding contractors, to flooring contractors and organizing a home mortgage loan, here is how to build a house step by step.

During the planning stage of the project, you will be preparing a budget. Typically, this is your available cash plus the amount of money you can borrow on a home mortgage loan or home construction loan. For example, using $100.00 per sq. ft. for new home building costs as a ballpark figure, determine how many sq. ft. of house you can build.

For example, with a budget of $200,000 but you spend $40,000 on the land, you will have $160,000 left for the main build of your new house. Divide $160,000 by $100 per sq. ft. – equals 1600 square feet. This should be your footprint for the new house.

Setting your budget and understanding where your cash will go right from the beginning will help you tremendously throughout the other later stages of the project.

The next step following the budget, is buying your building lot (land). If you have lived in a specific city, town or area for a while, you’ll probably know roughly where you want to build a new house.

If you haven’t been looking around much, or if you’re new to the area, I highly suggest that you work with a local realtor to help find you the perfect lot. These realtors know what each neighborhood can offer homeowners (including schools, entertainment venues etc) and what lots cost in different locations. If you’re looking to maximize the amount of acreage you get for your money, a realtor will be extremely helpful for this too.

A realtor can not only help you to locate the right property area you want, they can also help you with all the details necessary to assure you that it’s a suitable building site, such as my checklist below…

1. Is water and sewer already provided.

2. All costs to get the water and sewer to your property line (if it is not already there – it may have to come from across the street for example); tap-in fees or privilege fees charged by the municipality or the association providing the services.

3. Cost of well and septic tanks if water and sewer are not available.

4. Costs and availability for gas, electrical, phone and cable services.

5. Deed restrictions as to structures allowed and minimum setbacks from the main road.

6. Cost of local impact fees, if any. One way or the other, you – the buyer – end up paying these fees. Impact fees and other government associated fees are one-time fees imposed by some local governments on new developments or proposed developments for the purpose of paying for new or expanded public capital facilities (such as schools, utilities, roads, etc.), required to serve that development.

In some areas these fees can be excessive. This can be due to location, local demand in the area and many other factors. You should find these fees out early on in the process when you are searching for a building site so they don’t surprise you when you find the perfect lot.

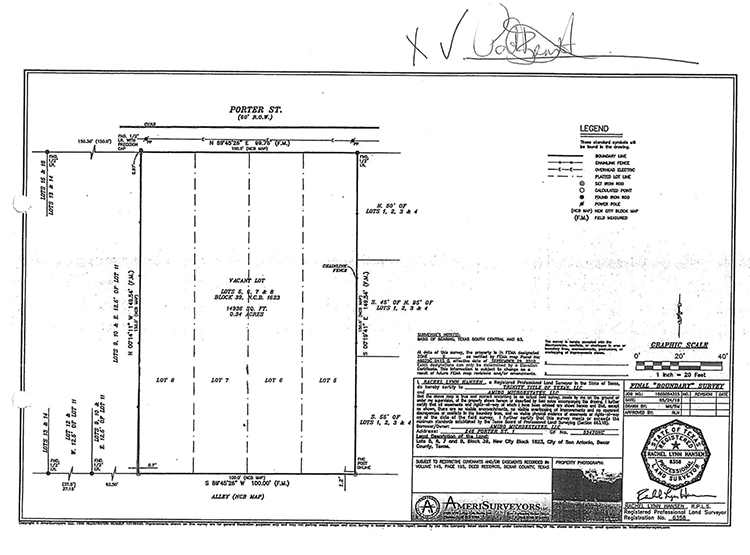

When viewing lots for your new house build, the realtor should be able to show you a land survey (map) of the lot and point out the boundaries to you during the walk around. IMPORTANT: Land surveys are crucial. A seller should provide and pay for a land boundary survey. But if they don’t, and you really want the land, then you should pay for it, and any responsible title company should never close without asking for a survey. Later on, a foundation survey will show where the new house is being built on the land in relation to the boundaries.

A boundary survey measures and locates the property lines and is based on the legal description of that specific piece of land. The proper written legal description of the property is called “metes and bounds” which goes into more detail to carefully explain the measured distances, angles, and directions.

A foundation survey is used to ensure minimum property setbacks as required by local zoning and show property deed restrictions have not been violated. These foundation surveys can also be called mortgage surveys, or mortgage reports. Your construction loan lender and/or mortgage lender will require this survey before disbursing any funds (money) for the sale. You, as the borrower, will be paying for this type of survey.

I have read about instances where foundations have straddled property lines, houses or structures were built too close to property lines, were in violation of minimum setback requirements, had their well drilled on the neighbor’s property – and probably worst of all – had a railroad easement running through the living room. These mistakes were made because the builder started construction before looking at a survey, and could have easily been avoided.

All the problems I’ve shared above were eventually resolved, but it took a considerable amount of time and money to do so. Which when you are building a new house – is not on your side. When such setback violations occur, all work grinds to a halt until such time as the foundation is moved, torn down, partially rebuilt, or a variance issued. In some extreme cases, the adjoining property must be purchased in order to move forwards.

When you’re looking for a lot, start off by finding a realtor that specializes in land. This could save you huge amounts of time and money in the long run.

Another source for your new home building site could be via a new home builder or new home development. Builders and developers sometimes find themselves with too many building lots and are willing to sell them.

There are some advantages to buying a lot from a new housing development. These include:

- You should be able to get a good price for a lot on a new homes’ development on a regular housing market, but right now the housing market is experiencing a lot of turbulence!

- New home builders rarely choose undesirable locations so they are likely to meet your wants and needs for a lot.

- An area with new housing developments is usually a sign of a good area to live.

- Generally speaking, all public utilities and services that a new home buyer desires are available.

Important: You should always find the land to build on first, determine your budget based on the size and cost of the lot, and then find home plans to fit with your budget and lot.

The next blog post in this Series will focus on house plans and estimating the build cost of your new home! So make sure you tune in next time to explore the next stage of building a new house.

Have you considered building a new house before, or built a new house? Or experienced these early stages of a project before? I’d love to hear about your experience in the comments section below!